How does it work?Did you know, you might be able to claim relief on your 2024 income tax by making a once-off payment into your pension? The closing date for claiming tax relief is 31 October. This once-off payment is also known as an AVC or Additional Voluntary Contribution. | ||||

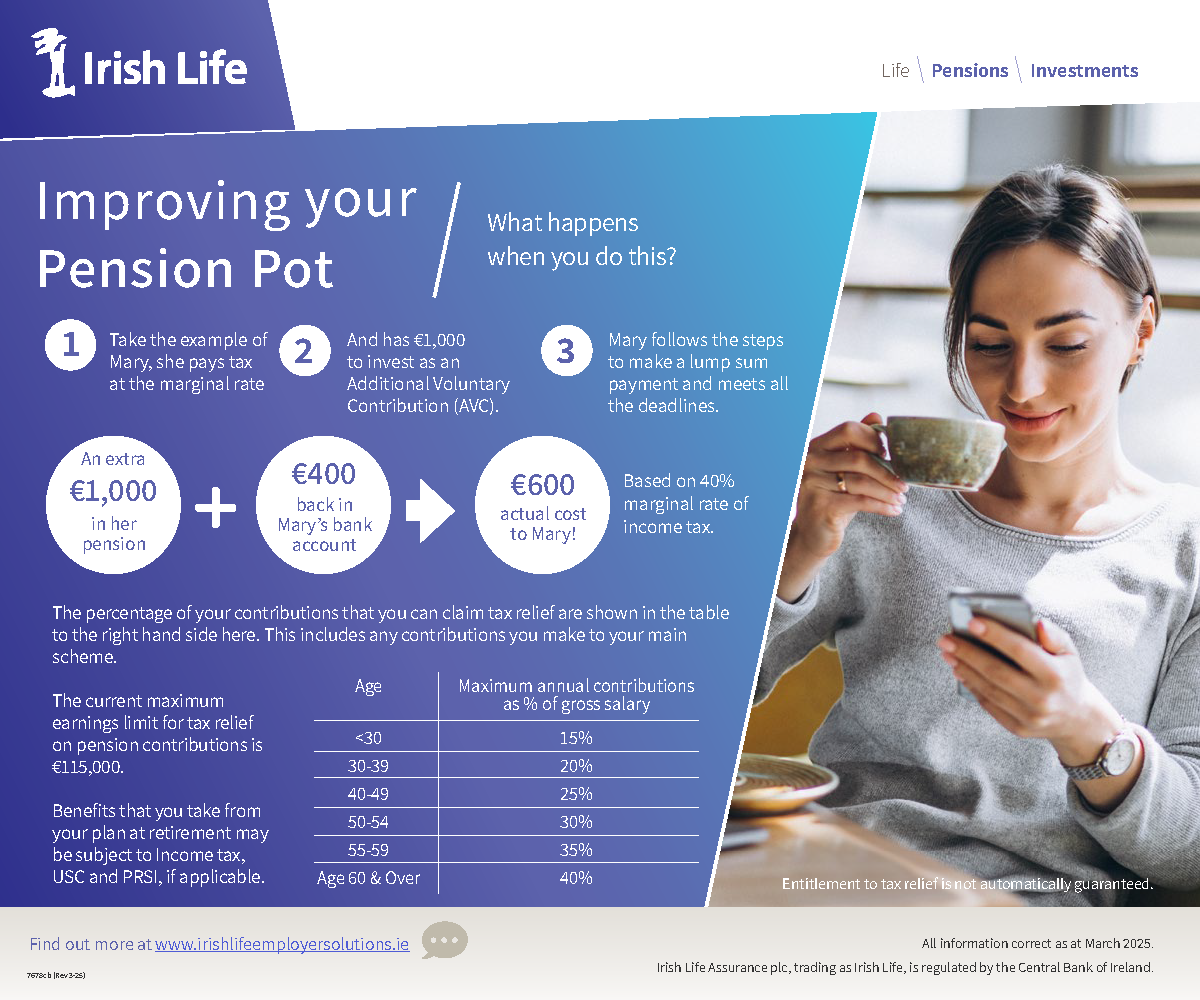

Example | ||||

| Let’s look at an example, say you are in the marginal tax bracket (paying 40% income tax) and want to top up your pension with an AVC of €1,000: | ||||

| Pension pot topped up with €1,000 | Claim your tax back €400 | Actual cost to you €600 | ||

| Note that the granting of tax relief is at the discretion of your local Inspector of Taxes and is not guaranteed. | ||||

What does that mean for you?In the example above, your pension savings get the full €1,000 top up, which is invested in your pension pot until you retire. This year, 2025, you get to claim back at your marginal tax rate of 40%. That’s €400 back in your pocket. Which means it only actually cost you €600 to top up your pension by €1,000. | ||||

File deadline for ROS customersIf you pay and file through ROS the deadline is mid November. Further information can be found at Revenue. | ||||

| ||||

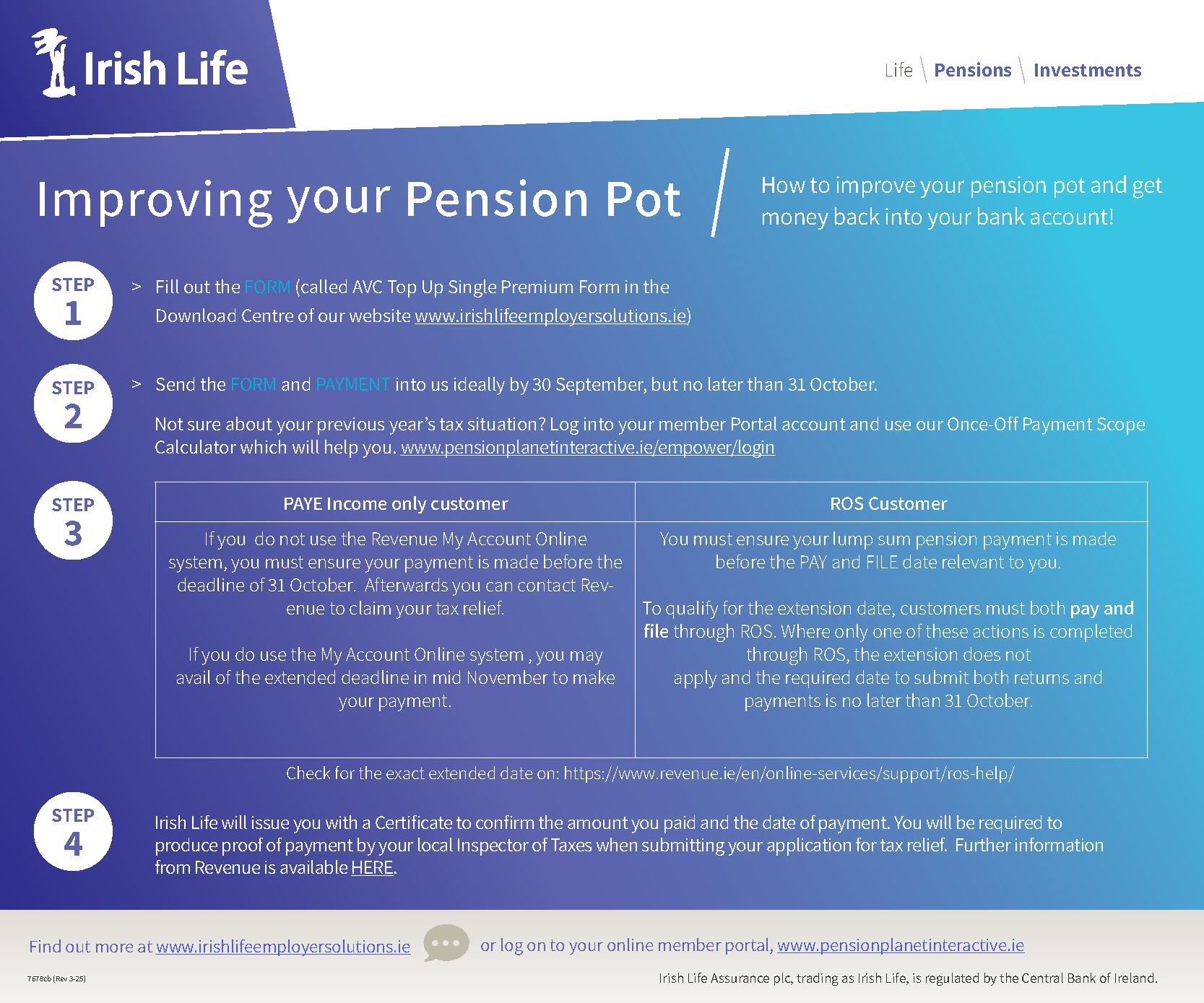

What are the next steps?Important things to consider before you make a payment to qualify for tax relief:

| ||||

| ||||

| ||||

Top Up FormComplete the top up form and send the payment to us, by cheque or bank transfer. | ||||