|

Irish Life Company Pensions – Trust the Pension MastersBy partnering with Irish Life, you are offering your people a market leading pension benefit proposition. As the largest defined contribution (DC) pension provider in Ireland, Irish Life is leading the way for pensions in Ireland, across all the areas that matter, from Member Communications to Investment Management, and Environmental, Social and Governance (ESG) to Administration. |

|

Member Campaign: Navigating Revenue Deadlines

To support your people throughout this process, we ran a multi-channel countdown campaign in the 8 weeks leading up to the Revenue deadline, across email, social media, webinars and website, sharing guidance and all the key information that members need to know to maximise their tax relief within the timeframe. To learn more, visit the campaign webpage below. |

In the News

From trending topics such as Auto-enrolment, to leading on crucial conversations like pension proactivity, you can count on us to keep you up to date on all things pensions. Explore the latest news below. |

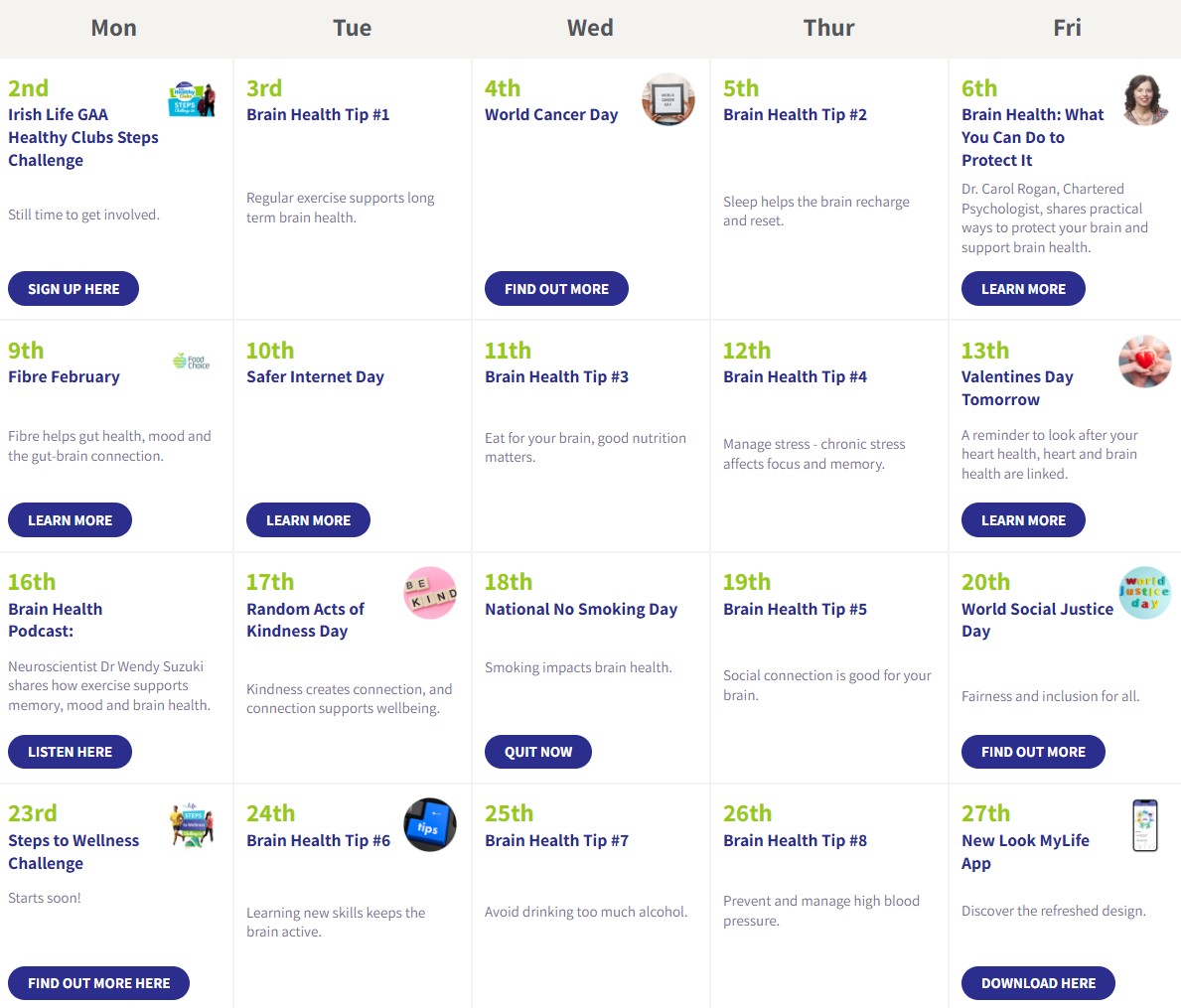

Wellbeing CalendarOur February Wellbeing Calendar focuses on the importance of looking after our brain in our daily routines. Explore the calendar below to discover a podcast featuring Neuroscientist, Dr Wendy Suzuki, who explains how exercise supports memory and mood, an upcoming MyLife Steps to Wellness Challenge to help us get moving and 8 top tips to optimise brain health. |

|

Irish Life Wellbeing Limited is not a regulated financial services company. |

|

|---|

Our experts regularly feature in the press, speaking on the key things that matter, today.

Our experts regularly feature in the press, speaking on the key things that matter, today.