AE is a government retirement savings scheme for employees who are not already actively paying into a pension arrangement through payroll. The aim of AE is to build a culture of saving for retirement in Ireland. The idea is that in retirement, most workers will have their own pension as well as the State Pension, leading to a better retirement income overall.

*800,000+ workers in Ireland, do not have any pension coverage currently and, as a result, will depend on the State Pension as their main source of income in retirement. This means they may see a drastic reduction in their income and living standards. AE will increase both pension coverage and overall pension adequacy by making it easier for employees to access a quality assured retirement savings plan. This system has been successfully implemented in other countries, such as the UK and New Zealand, with strong results in boosting pension participation rates.

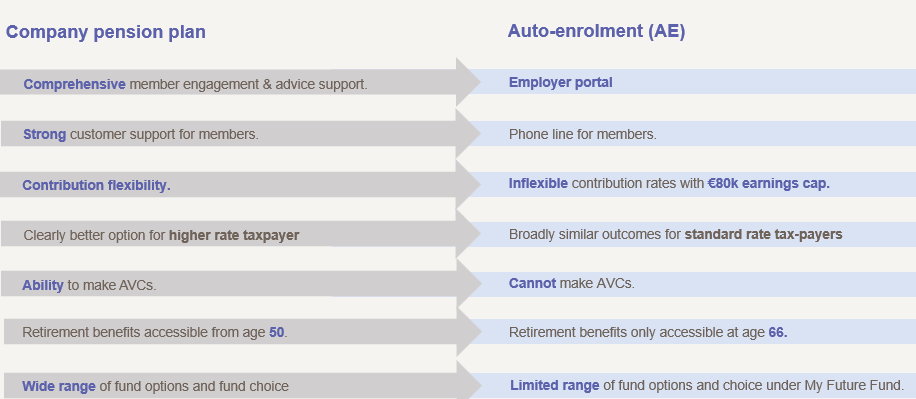

It's important to note that many of these workers would be better off joining their company pension plan. However, for those who can’t avail of that option, there is AE.

Eligibility

AE will apply to every private sector worker in Ireland if they are:

- Aged between 23 and 60

- earn more than €20,000 per year from all employment

- and are not currently paying into a company pension or personal pension through payroll.

Enrolment is mandatory for the first 6 months. Members can opt out in months 7 and 8. Those who opt out will be automatically re-enrolled after 2 years.

Employees who do not satisfy the age or earnings thresholds will have the right to opt-in to the AE system, if they choose.

Contributions

- Contributions will be mandatory and need to be made by the employee and employer with a top up from the government.

- Contributions will start at 1.5% of gross earnings, gradually increasing by 1.5% every three years until both the employee and employer are paying to 6% of gross earnings.

- Employer Match: Employers must match employee contributions up to a specified limit.

- State Top-Up: The government will contribute €1 for every €3 saved by the employee, equivalent to a 33% bonus. This means that somebody earning €40,000 will be contributing €600 per year, and their employer and the Government will be adding €800 to their pension fund between them.

- After three years, the contribution increases to 3.0% and the employer and Government contribution increase proportionally. After another three years, it increases to 4.5%, and after 10 years it increases to 6.0% and remains there.

| Years | Employee Contribution | Employer Contribution | Government Contribution |

0-3 | 1.5% | 1.5% | 0.5% |

4-6 | 3% | 3% | 1% |

7-9 | 4.5% | 4.5% | 1.5% |

10+ | 6% | 6% | 2% |

Source: Houses of the Oireachtas (2024). (Automatic Enrolment Retirement Savings System Act, 2024, p. 51)

Note: Employer and Government contributions apply only to salaries up to €80,000. If a person earns more than this, the percentage figure for the employer and Government contributions will be limited to the first €80,000 of gross earnings.

Opt-Out Provision

Enrolment is mandatory for the first 6 months. Members can opt out in months 7 and 8. Those who opt out will be automatically re-enrolled after 2 years.

Investment Options

The National Automatic Enrolment Retirement Savings Authority (NAERSA) will provide employees with a limited range of investment options including a low to medium risk default fund, which will operate on a lifestyle basis, together with three other fund options, classified as low, medium, and high risk.

Investment managers will be appointed to provide funds that will form the investment strategy options for the investment of contributions, including:

- a low-risk strategy

- a medium-risk strategy

- a high-risk strategy

You will be placed in a default strategy to begin with and will have the choice to move to one of the other strategies listed above.

The default strategy will operate on a typical lifecycle basis, which means that the investment risk is decreased as you get closer to retirement. This strategy will see you move from the higher to the medium to the lower risk strategy, based on your age and the number of years remaining until you reach the State Pension age of 66. This strategy takes advantage of high-risk growth in younger years, and the stability of low risk closer to typical retirement age. The default strategy will be structured in a way so that you will not need any financial knowledge or to make choices to get a good retirement income.

Measures will be in place to ensure that these savings, while not guaranteed by the government, will be managed carefully. This includes a rigorous tender process to select investment managers and oversight by the NAERSA Board, the Pensions Authority and the Financial Services and Pensions Ombudsman.

Transferability

Workers can retain their AE pension savings as they change jobs, ensuring flexibility and continuity in their retirement planning.

Administration Charges

Charges will be set nearer the launch date of 1 January 2025, but it is expected there will be:

- A maximum Annual Management charge (AMC) and

- a flat per member charge (to be confirmed).

Key Takeaway |

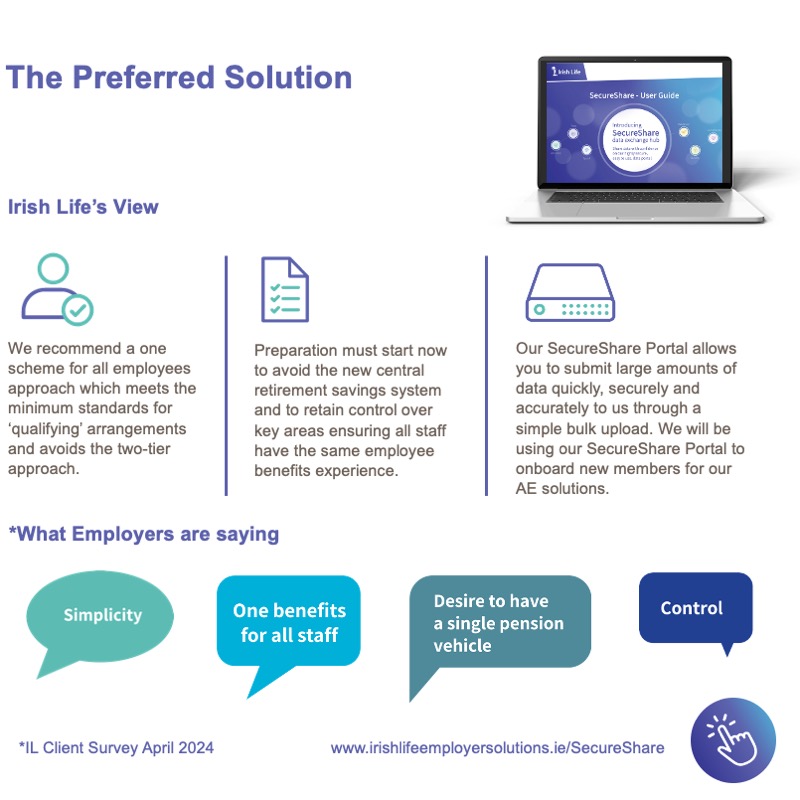

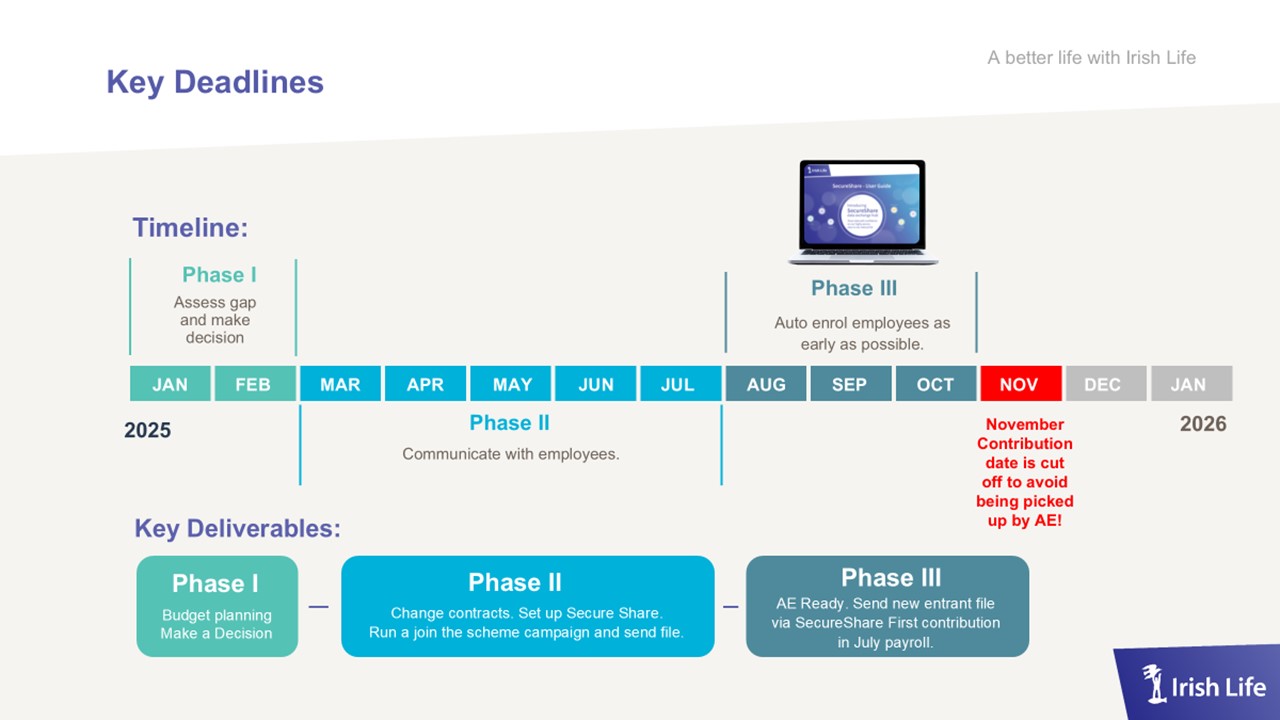

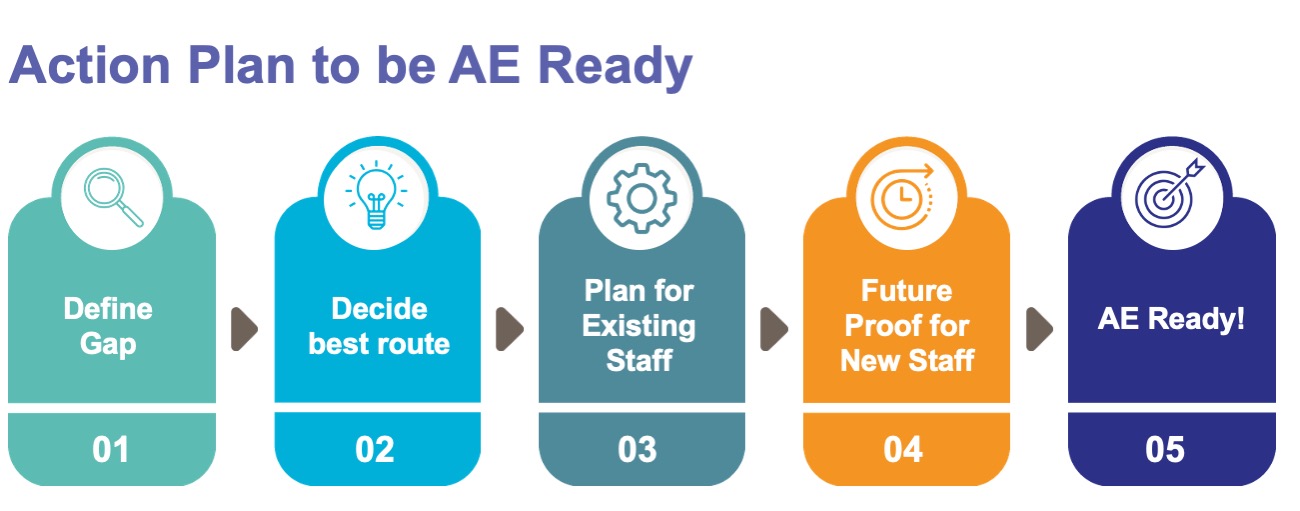

| At Irish Life, we recognise there is unlikely to be a single approach that suits all employers or circumstances. However, our recommended course of action is to have one pension scheme for all employees that meets the minimum standards for ‘qualifying’ arrangements and avoids the two-tier approach. Employers should also note that all new joiners must have their first contributions processed through payroll by the end of November. This process can require several weeks of preparation given standard payroll lead times. For some monthly paid plans, it may mean sign-up must be completed by the end of October to meet the deadline. |

|

By acting today and extending your existing pension plan to all employees now, you ensure a smooth transition, stay in control with one simplified scheme, and support your people beyond the State minimum.

If you would like to prepare for AE with confidence, speak to your Irish Life contact or alternatively, email us at AEready@irishlife.ie today. |

[1] Auto-Enrolment Guide for Employees | Gov.ie – March 2024 [2] Population Ageing and the Public Finances in Ireland | Department of Finance – September 2018 [3] Automatic Enrolment Retirement Savings System Act, 2024 │ Houses of the Oireachtas 2024 |

Irish Life Assurance plc, trading as Irish Life, is regulated by the Central Bank of Ireland. |