| |

Irish Life EMPOWER Master TrustBy joining the Irish Life EMPOWER Master Trust, your pension plan is part of something exceptional. Our award-winning EMPOWER Master Trust was designed not just to meet regulatory requirements in this space, but to exceed expectations and set the standard for the industry as a whole. As EMPOWER Master Trust participants, both you and your plan members will benefit from a market leading master trust proposition, which will flex and evolve over time to meet any industry or regulatory challenges, as needed and continue to lead the way for pensions in Ireland. The Irish Life EMPOWER Master Trust has some standout features that set it apart... | |

| |

Quarterly Investment UpdateYour quarterly investment update from Irish Life Investment Managers is designed to:

| |

Annual Renewal Process of your EMPOWER Master Trust Plan

You can use this step-by-step guide to help you prepare and understand the key compliance tasks for you as an Employer, as well as the Trustees and Irish Life. Get ahead of the deadline today! | |

Member Campaign: Navigating Revenue Deadlines

To support your people throughout this process, we ran a multi-channel countdown campaign in the 8 weeks leading up to the Revenue deadline, across email, social media, webinars and website, sharing guidance and all the key information that members need to know to maximise their tax relief within the timeframe. To learn more, visit the campaign webpage below. | |

In the News

From trending topics such as Auto-enrolment, to leading on crucial conversations like pension proactivity, you can count on us to keep you up to date on all things pensions. Explore the latest news below. | |

| |

Member Engagement UpdateRecent and upcoming highlights from our Pension Education webinars and campaign communications include:

Our new, bitesize video series answers the most frequently asked pension questions, making it even easier for members to get the key information they need, right when they need it. Watch the videos now. We are additionally delighted to share an accessible version with Irish Sign Language.

Watch on-demand: Essential Guide to Retirement Part 1 Our highest attended event in the last quarter was our Essential Guide to Retiring Part 1, showing strong demand for member supports at this key life stage. This session guides members through the typical retirement process and how it works, and helps them understand what options may be available.

| |

2026 Member Engagement Events CalendarA key element of our journey based persona driven member engagement program is our 2026 Pension Education Series. Jam packed with targeted, relevant content and engaging member webinars, this series has been designed to build ever further upon the 2025 member experience, continuously using our learnings and insights to shape the approach. | |

| |

Useful Shortcuts | Frequently Asked Questions (FAQ)This FAQ resource is designed to help your team to answer some of the most common queries that your members are likely to ask, without reinventing the wheel each time. |

Guidance in a master trust worldIrish Life is on a mission to help your members harness the power in their pension.

Resources & supports include our new Pension Education Series, a comprehensive communications calendar, the award-winning Pension Portal and our dedicated Pension You can find out more on our Member Hub.... | |

| |

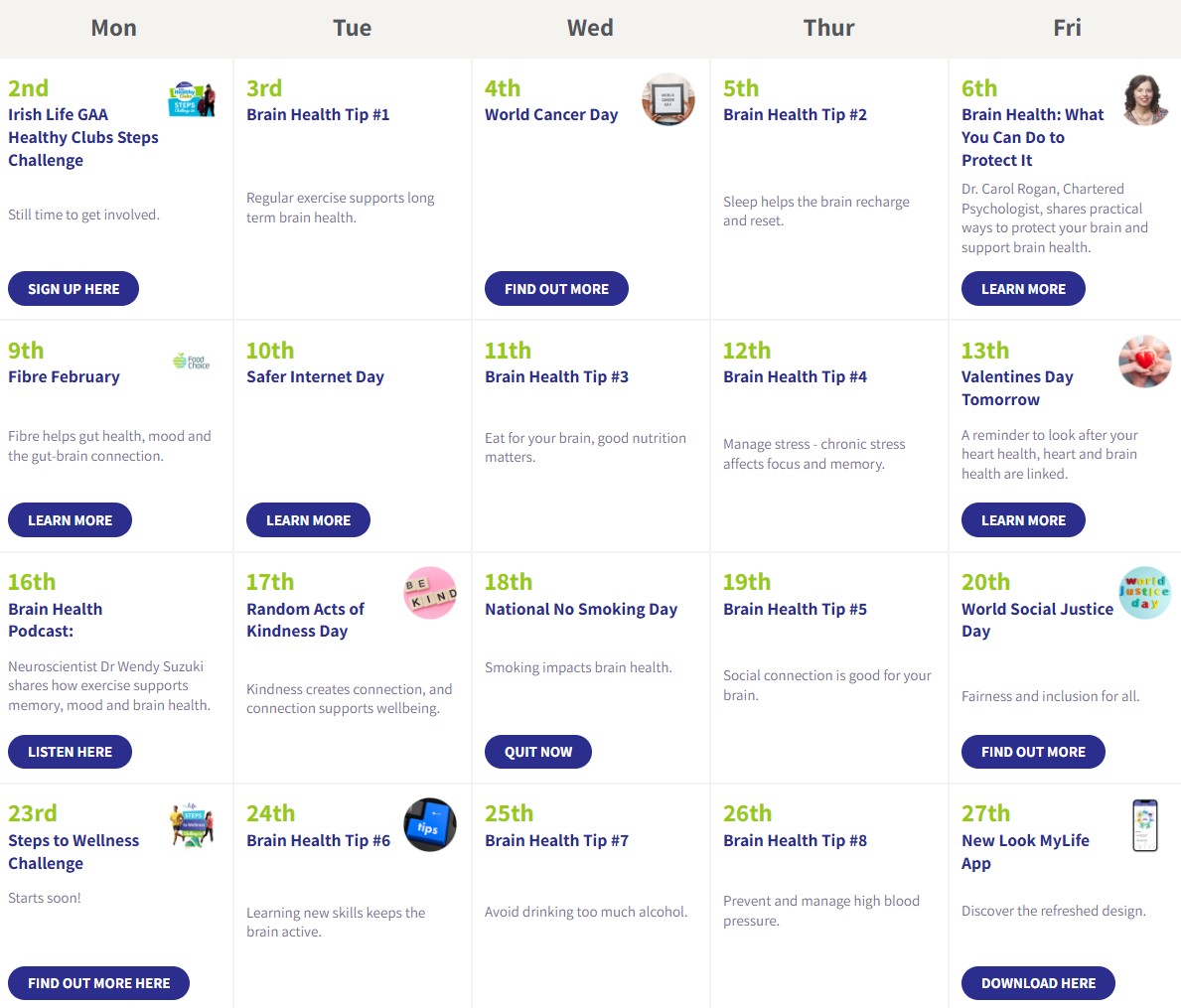

Wellbeing CalendarOur February Wellbeing Calendar focuses on the importance of looking after our brain in our daily routines. Explore the calendar below to discover a podcast featuring Neuroscientist, Dr Wendy Suzuki, who explains how exercise supports memory and mood, an upcoming MyLife Steps to Wellness Challenge to help us get moving and 8 top tips to optimise brain health. | |

| |

Irish Life Wellbeing Limited is not a regulated financial services company. | |

|

|---|

Get up to speed quickly & easily

Get up to speed quickly & easily

Our experts regularly feature in the press, speaking on the key things that matter, today.

Our experts regularly feature in the press, speaking on the key things that matter, today.