One of the key factors when it comes to the likely outcome for a DC pension scheme member is how early they join the company pension scheme.

People talk a lot about making good levels of contributions and about making the right investment choices. Just as important is giving the DC (defined contribution) pension fund enough time to grow, so that the amount of time contributing to the pension plan is as long as possible.

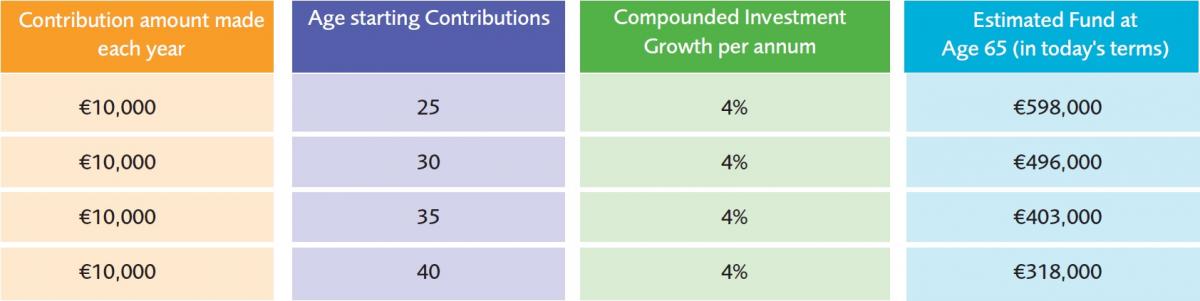

The table below takes a €10,000 annual contribution (linked to salary, so increasing with salary growth) into a DC pension plan and works out how much this contribution could accumulate to, depending on when a member starts contributing.

Source of figures: Irish Life Defined Contribution Retirement Readiness Report 2014, June 2014

These illustrations assume an investment return before retirement of 4% per year up until retirement and inflation/salary growth of 2%. These rates are for illustration purposes only and are not guaranteed. These figures do not allow for the government pension levy of 0.15% in 2015. Actual investment growth will depend on the performance of the underlying investments and may be more or less than illustrated.

Some interesting points that emerge from this table are:

- Assuming a retirement age of 65, someone who starts contributing at age 30 will end up with a fund of over €496,000 based on the assumptions outlined above.

- However, if the same member delayed starting in the DC scheme until five years later (age 35), their fund at retirement is likely to be over 18% lower.

- While, if the same member delayed starting contributions until age 40, their projected fund at retirement would be less than €320,000, over 1/3 less than if they had started at age 30.

A key lesson for all DC pension scheme members is:

- Start early.

- Give contributions as much time as possible to accumulate and take advantage of investment gains.

Take action

Use our pension calculator to help you see how your retirement income is shaping up. You can even input some information from your annual benefit statement to get a more accurate projection.