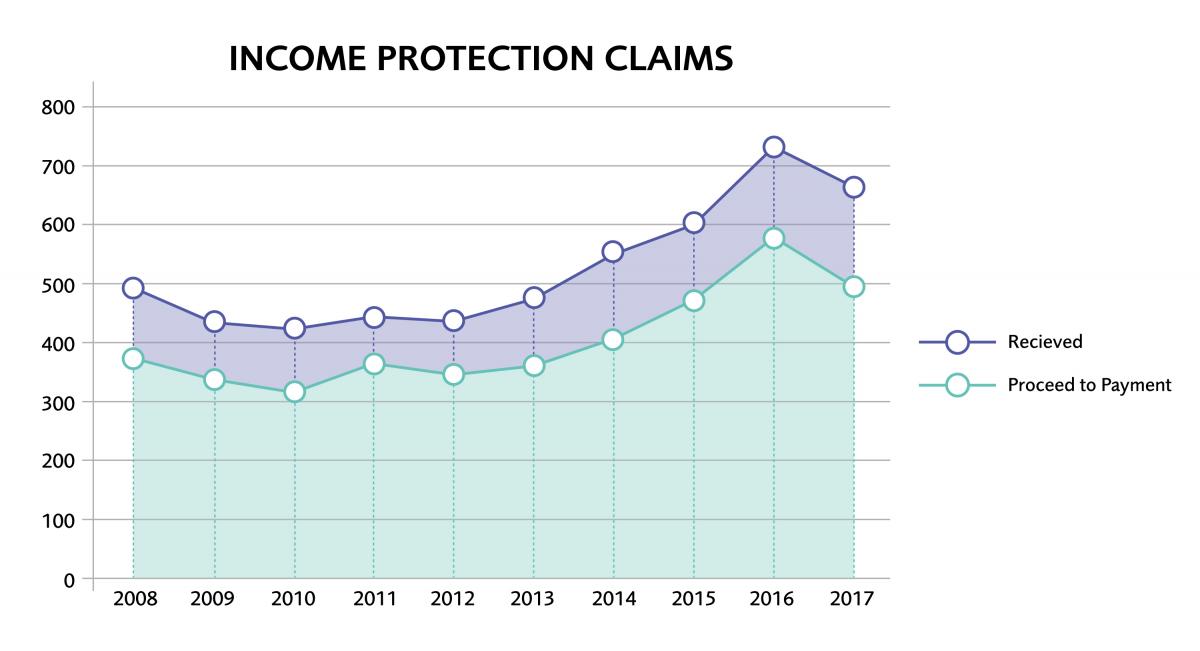

With the largest book of Income Protection (IP) claims in Ireland, Irish Life has unique early insights into trends in claim statistics and carries out regular assessments of experience. Our latest analysis has shown a disturbing recent trend with a significant rise in the number of Income Protection claims made by employees from 2014 to 2017.

This increase in claims for a number of people is across all sections of the workforce, including different age ranges, genders and company types.

Source: Irish Life claims data adjusted for changes in number of insured lives.

Why is this happening?

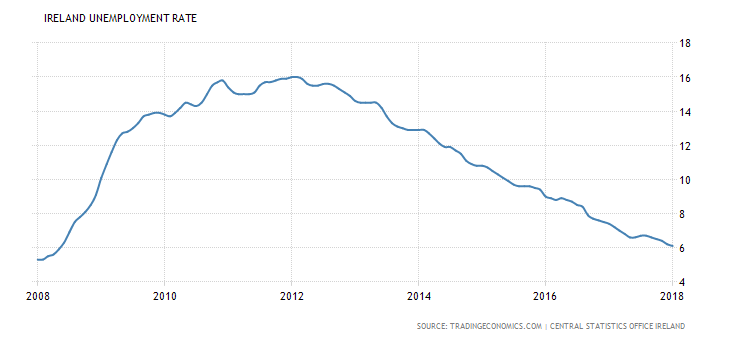

Employee absenteeism and claim rates can follow cyclic patterns in response to many socio-economic drivers. During the downturn in the Irish economy unemployment began to increase rapidly from 2008 onwards. While in previous economic cycles this coincided with an increased number of people claiming, this did not occur in the recent Irish downturn. The recession actually coincided with slightly fewer IP claims than the previous year.

It’s plausible that during the recession, many employees who could have validly made an Income Protection claim elected to remain in work (we call these the “working wounded”). However, following an improvement in Irish employment expectations this “presenteeism” has now come to an end and as a result a sharp rise in claim numbers has occurred. By deferring short periods of convalescence some employees may now be suffering from more serious long term conditions, causing them to need to claim Income Protection.

Irish Life is satisfied that this trend is not isolated to any single section of the workforce. The increased claim effect has been noted within all industries, male and female employees as well as small and large organisations. In many cases smaller schemes, which have never had a claim before, now have their first claims coming through. Most large schemes which always had some claims each year have also seen an increase in claims.

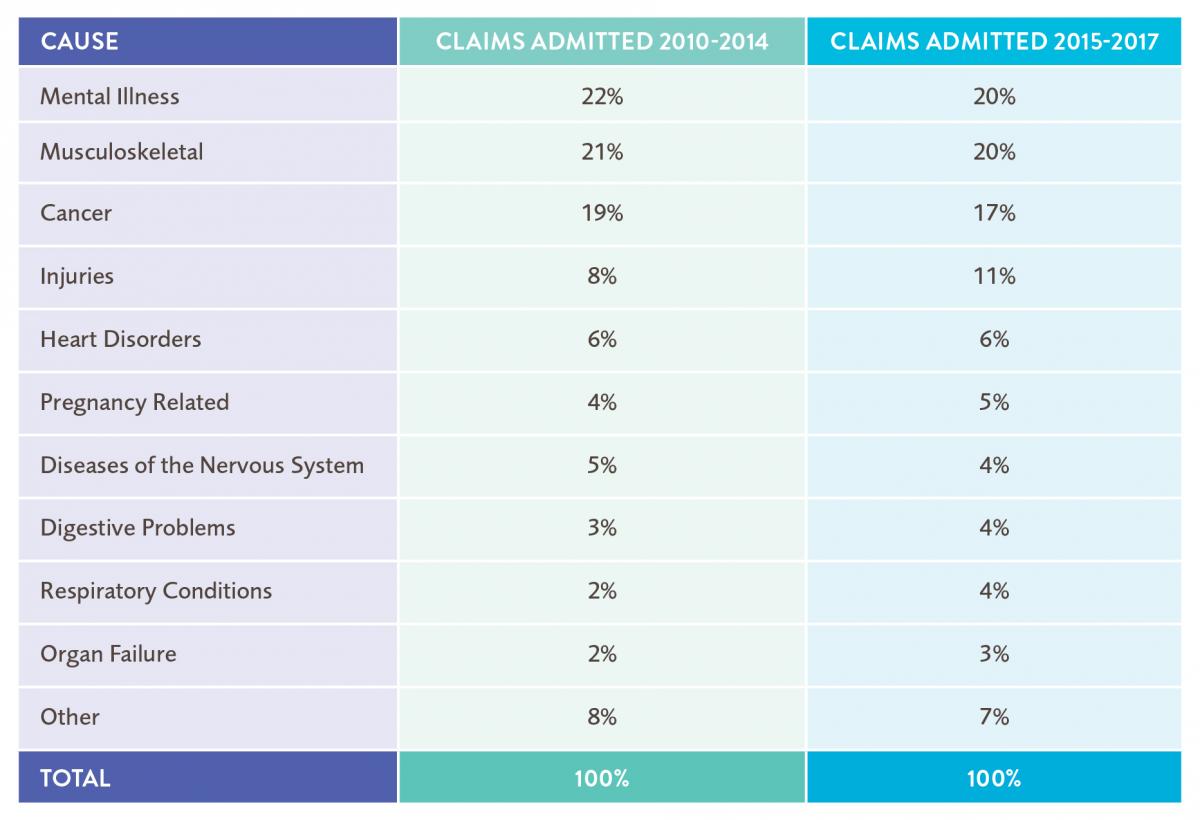

What causes are people suffering from?

There has been no distortional increase in any single claim cause and Irish Life has continued to only admit valid claims. Our assessment processes have remained robust and the rate at which we admit claims has remained stable.

In general the average age of the workforce has also increased during the recession. This is due to low employee turnover as a result of a reduction in hiring of new employees and also a reduction in employee resignations. While staff turnover has started to increase again in recent years, the average age of insured employees in our book has increased from 40.7 in 2010 to 42.5 in 2017 and continues to modestly increase.

In general, older employees claim more often than younger employees for Income Protection. However, the increased number of claims is in excess of what is typical with this change in age profile and certainly aging is only part of the story.

What is Irish Life doing in response?

It has always been, and always will be, Irish Life’s policy to pay valid claims. Income Protection is a very important and invaluable benefit which provides assistance to employees and their families when they are at their most vulnerable.

More of our customers are availing of our nationwide rehabilitation programmes than ever before. The average duration of an Irish Life Income Protection claim has reduced over the past number of years. However, Irish Life has responded to this challenge by investing significant resources into claims management which is helping employees return to work sooner and therefore reduce the length of time they would be unfit for work.

What does this mean for Premium Rates?

Income Protection is always priced prospectively by Irish Life. Past claim experience is only used where it is a good predictor of future claim volumes.

All Insurance companies set premium rates using a combination of the claims experience for each individual scheme as well as general Income Protection rates (the insurer’s own “book rates”). Very large schemes (i.e. 3,000 lives plus) are rated almost entirely on their own experience, whereas a small 10-person scheme (which would only be expected to produce a claim once every 20 years) would be priced entirely on general book rates. Premiums for medium sized schemes would be based on a combination of both.

We have seen an increase in the number of claims throughout a large number of schemes within the Irish insurance market. Many of these schemes are still experiencing significant price rises at rate review. While Irish Life has reduced the average payment duration of claims, this has not been enough to offset the effect of increases in expected claim receipts.

Smaller schemes are also likely to experience rate increases in line with changes to claim levels in the general Irish population.

What can Employers do?

Irish Life encourages all employers to adopt a flexible and active approach to employee absence management.

- Ensure that you have an absence management system, and that all absences are reported to HR as soon as possible.

- Refer your absent employees to an Occupational Health Physician in the process.

- Consider supporting your affected staff through the Irish Life rehabilitation options.

- Be flexible: phased return to work programs and facilitating alternative work arrangements all contribute to shortening the duration of claims.

Ultimately, engaging early and openly with Irish Life’s Claims Managers will produce the best chance of an employee returning to work early, possibly even before they reach the end of the deferred period.

Note: Not all claims received by Irish Life will be admitted. This can occur for a variety of reasons. Many claimants return to work voluntarily before a claim is due to enter payment, some potential claimants will unfortunately die before the end of the deferred period while a small sub-section will not meet the definition of disablement.